With revaluation under way, look for ‘significant’ increases

Property tax is based on valuation and rate

April 5. By Dave Vieser. On an evening with a light agenda, Cornelius commissioners spent much of their meeting on a detailed update from the Mecklenburg Tax Assessment Officers Office regarding property revaluations.

Deputy Assessor Brad Fowler said that a team of eight county workers and a senior manager have been laser-focused on the reval process since the beginning of the year, backed up by some 40 appraisers.

As of this week, the team had completed an initial review on 89 percent of all properties.

Tax values are one of two major factors determining the property taxes paid by homeowners and businesses starting next year. The other factor is the tax rate which is established by each municipality in conjunction with their annual budgets which must be adopted no later than July 1, 2023.

$7.55 billion town

Cornelius currently has a total tax value of $7.55 billion. As of the moment, the median residential sales price in the county is approximately $367,000.

Significant value changes

“It appears at this point that there are going to be significant valuation changes when our reval is completed,” said Fowler. “Its no secret that the Charlotte area real estate market has been a very hot one.”

Details

The new final values will be established by Jan. 1, 2023, with property owners getting their new tax values that month. Those wishing to appeal can do so before the official tax bills are mailed in July of 2023, payable on or before Sept. 1. Interest begins to accrue if the bills are not paid by the start of January 2024.

Fowler urged taxpayers to access the county web site to obtain additional information on assessment programs: www.mecknc.gov.

In other action

Photo by Jason Benavides

—The commissioners adopted a proclamation saluting the men and women who serve as public safety communicators. The second full week of April is so designated and Cornelius has had a crew of 911 operators on the job in Police Headquarters since 1993. There have been close to 1 million calls for help over the 29 years of service.

—The Town Board also adopted a second resolution naming April 12 as Education and Sharing Day, in memory of the Lubavitcher Rebbe, Rabbi Menachem Schneerson in recognition of his many contributions towards improvements in world education.

5 Comments

Comments are closed.

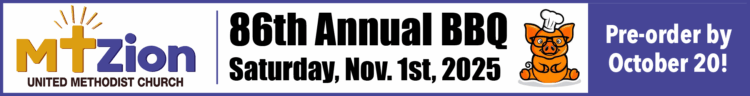

Our Partners

In 2-3 years when property values go down, will there be rebates extended to the property owners?

Good question , why are they doing this again . My taxes went up 2 years ago , it’s just not right.

Revaluations are slated to occur every 4 years to ensure that significant up or down years don’t adversely affect homeowners over long periods of time.

Just because your property is revalued doesn’t mean your taxes will go up (though, honestly, when will they ever go down?). The city asks for an amount of tax dollars to conduct its business (a levy), and that levy is (roughly) divided by the total valuation to come up with a tax rate. Assuming the city asks for the the same amount of money this year as it asked for last year, and the total valuation goes up, the tax rate goes down.

Mecklenburg County revalues all property every 4 years, and individual properties are revalued when they sell. If the market crashes in 2 years, you can always appeal your property’s valuation to try and have it lowered. I don’t know how likely this process is to succeed in NC.

Revals seem like they should suck (and sometimes they do!), but by and large, it helps the residential homeowner in areas that are growing quickly like ours. Vacant land that is turned into housing is added to the tax rolls more quickly (which helps your tax rate go down), and commercial properties are valued higher than residential, and that also helps keep your tax rate down. Of course, lots of commercial growth can cause other problems, but I won’t go into that rant here :)

All this is to say that your taxes can still go up, but hopefully this will give you a little insight into how the process works.

FYI, I don’t work for the city or the county. I used to write software that calculated property taxes, so I have some insight into how this process works. Compared to many of the states I worked in, property taxes are still pretty reasonable (and frankly, is one reason why I moved here) – the taxes I pay on the house I own in Cornelius would be 4x higher in rural IL.

Hope this helps!

I would hope taxes are less here. We don’t have to buy and use expensive snow removal equipment or other lake related expenses, etc.