WalletHub survey says NC economy will be among most affected by COVID

April 1. Nearly nine out of 10 business owners say they are hurting from the economic impact of COVID-19, according to WalletHub’s new Coronavirus Small Business Survey. This survey methodology puts North Carolina at No. 15 on the list of “State Economies Most Exposed to Coronavirus.”

Countless non-essential businesses have closed, while safe distancing means events ranging from funerals to meetings and conventions have either been cancelled or indefinitely postponed.

Click here to view the WalletHub report.

WalletHub compared the 50 states and the District of Columbia across two key dimensions, “High Impact Industries & Workforce” and “Resources for Businesses to Cope Better with the Crisis.”

A third of small business owners say their business can only survive for less than three months in current conditions.

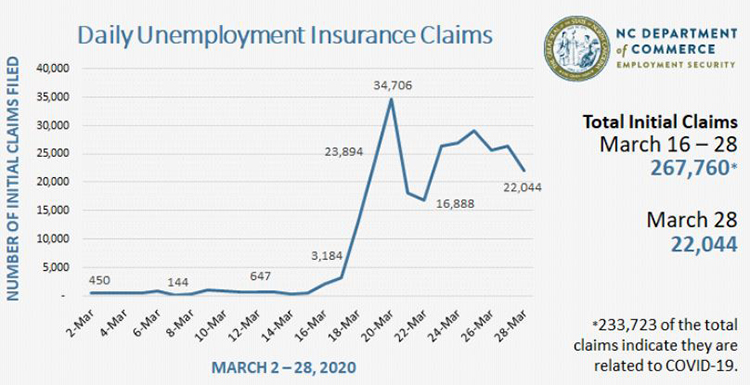

States with larger proportions of accommodation and food services; arts, entertainment and recreation; and transportation businesses were more at risk. Other data measured includes share of employment from small businesses to share of workers with access to paid sick leave and increase in unemployment insurance claims.

In fact, economist John Silvia said COVID-aware “people will want space between themselves,” directly impacting businesses like theaters, restaurants and casinos.

JOHN SILVIA, ECONOMIST

On the flip side of WalletHub’s metrics are individual states’ use of technology to improve service delivery, increase capacity, streamline operations and reach policy goals, as well as the share of people working from home and the intrinsic work-from-home infrastructure, i.e. access to high-speed internet and communications.

Neighboring Georgia will be the least affected by COVID-19, according to WalletHub; South Carolina comes in at No 22. The most impacted state will be Louisiana.

| Overall Rank | State | Total Score | ‘High Impact Industries & Workforce’ Rank | ‘Resources for Businesses to Cope Better with the Crisis’ Rank |

|---|---|---|---|---|

| 1 | Louisiana | 68.12 | 1 | 4 |

| 2 | Rhode Island | 63.17 | 2 | 16 |

| 3 | Nevada | 60.71 | 3 | 23 |

| 4 | Maine | 57.58 | 4 | 31 |

| 5 | New Hampshire | 55.98 | 5 | 39 |

| 6 | Pennsylvania | 54.34 | 8 | 15 |

| 7 | Montana | 54.27 | 6 | 36 |

| 8 | New Jersey | 53.32 | 15 | 5 |

| 9 | Massachusetts | 51.91 | 7 | 27 |

| 10 | Illinois | 50.57 | 24 | 3 |

| 11 | Kentucky | 50.35 | 34 | 1 |

| 12 | Michigan | 50.17 | 20 | 14 |

| 13 | Ohio | 50.02 | 18 | 18 |

| 14 | New Mexico | 49.53 | 10 | 33 |

| 15 | North Carolina | 49.36 | 16 | 22 |

| 16 | District of Columbia | 49.23 | 9 | 38 |

| 17 | Minnesota | 48.90 | 11 | 35 |

| 18 | Kansas | 48.03 | 29 | 6 |

| 19 | Indiana | 48.02 | 23 | 11 |

| 20 | Maryland | 47.25 | 22 | 19 |

| 21 | Mississippi | 47.12 | 44 | 2 |

| 22 | South Carolina | 46.39 | 30 | 13 |

| 23 | Florida | 46.25 | 19 | 37 |

| 24 | New York | 45.70 | 26 | 17 |

| 25 | Colorado | 45.60 | 14 | 44 |

No Comments

Leave A Comment

Our Partners

Such a positive story for our community!! Especially for all of our great Small business owners locally. Great reporting! Just what we want to see in such tough times for our community, state, nation, and world. Who the hell is John Silva? Nice Metrics bud. But unfortunately the economic variables in the real world are different from the controls of your XY graph inputs you plugged into your model for you College Econ students. Ahh John works for the failed & cowering Wells Fargo Bank. The bank where all the executives are currently hiding. Another media failure at such a micro level. We now know how this scales right up to the national media levels & adds to the boiling pot of fear for Americans. Goodbye Cornelius Today. RIP

Sounds like you are out of bathroom tissue. FYI, there was a 6064.54% increase in the number of unemployment insurance Initial Claims——from 2,772 the week of March 25, 2019 to 170,881 the week of March 23, 2020. 4th highest in the U.S.